SDCL’s CEO and Founder, Jonathan Maxwell, was delighted to speak at the Atlantic Council’s Climate Action Solution Centre, as part of COP26 in Glasgow on 11 November 2021.

SDCL’s CEO and Founder, Jonathan Maxwell, was delighted to speak at the Atlantic Council’s Climate Action Solution Centre, as part of COP26 in Glasgow on 11 November 2021.

SDCL’s CEO and Founder, Jonathan Maxwell, sets out a key deliverable for COP26 – explaining how investors can deliver commercially sustainable, profitable and productive solutions to decarbonisation.

Please click on the following link to see the article here.

The U.S. and China affirmed their joint commitment to phasing down HFCs in line with the Kigali Amendment to the Montreal Protocol yesterday, following two days of talks between U.S. Special Presidential Envoy for Climate John Kerry and China Special Envoy for Climate Change Xie Zhenhua. The joint statement, part of a larger package of collaborative approaches to tackling the climate crisis, builds on the news of China’s decision to accept the Kigali Amendment last week.

Lolita Jackson, American business executive, to receive Honorary MBE

Honouree recognised for services to US and UK transatlantic relations

(NEW YORK – 18 MAY 2021): On behalf of Her Majesty Queen Elizabeth II, Antony Phillipson, British Consul General in New York and Her Majesty’s Trade Commissioner for North America, is pleased to announce that Ms. Lolita Jackson, former Special Advisor of Climate Policy & Programs, Office of the New York City Mayor, has been recognised by the UK Honours System. Ms. Jackson has been made an honorary Member of the Most Excellent Order of the British Empire (MBE) in recognition for her services to transatlantic business relations and climate diplomacy.

“I congratulate Lolita on her well-deserved honour,” said Mr. Phillipson. “For over a decade, she has championed UK-US relations across a wide variety of sectors. From climate finance to her former role as Chairman of the British American Project, Lolita’s tireless networking has provided the UK Government with invaluable support in the NYC-area and across the US.”

Since 2004, Ms. Jackson has been a firm friend of the British Consulate. As a fellow with the British American Project, she has helped the UK Government vastly expand their network of influencers across the US. She has also significantly enhanced UK-US ties through her leadership of the Royal Society of Arts in the USA; her work on climate resilience at the NYC Mayor’s Office (on which she has also boosted collaboration with the UK and been an advocate for UK climate goals); and her broader cultural links to the UK, and especially Scotland.

“I am thrilled to receive this honor. The very first trip I ever needed a passport for was to the UK over 25 years ago, and I have been engaging ever since with its people, its institutions and its culture through volunteer leadership and musical performance. From Edinburgh, to Cardiff, to Isle of Wight and all points in between – it has been a privilege to help foster relationships and engage deeply in British society.”

Ms. Jackson currently serves as Executive Director of Communications & Sustainable Cities with Sustainable Development Capital, LLP. She has been a fellow at the Royal Society of Arts since 2010, joining the Board of RSA US in 2013 and becoming US Chair in 2016. In this guise, she has hosted events throughout the US for fellows and interested parties, working with Consulates in Boston, Miami and San Francisco and the Embassy in Washington. She has also been a Trustee of the Children’s Aid Society Charity for more than 17 years. She is also a member of The Saint Andrew’s Society of New York.

The UK honours system recognises exceptional achievement and service to the nation, and includes non-British nationals who receive “honorary” awards for their important contribution to British interests. All British honours are awarded on merit, and honorary awards are conferred by HM The Queen on the advice of the Foreign, Commonwealth, and Development Office. Ms. Jackson may forthwith use “MBE” after her name should she wish to do so.

###

For more information, please contact:

Toby Usnik, Head of Communications

The Board is pleased to announce that the placing of New Ordinary Shares pursuant to the Company’s existing Share Issuance Programme (the “Placing”) announced on 4 February 2021 has received a strong level of support from investors.

Taking into account the strength of the Company’s near-term acquisition pipeline, the Board has determined to increase the size of the Placing to £160 million. Accordingly, the Placing will result in the issue of 150.9 million New Ordinary Shares at the Placing Price of 106 pence per share. Notwithstanding the increased size of the Placing, applications for the New Ordinary Shares exceeded the total number of shares to be issued and accordingly a scaling back exercise has taken place.

Tony Roper, Chairman of SDCL Energy Efficiency Income Trust plc said:

“We are grateful for the strong support we have once again received from both new and existing investors in this over-subscribed placing. The Company has a strong pipeline of both organic investments and new acquisition opportunities, which in total exceeds £200 million. In light of the strength of investor demand and reflecting our confidence in both the depth and near-term availability of the pipeline, we have increased the size of the placing. We also intend to repay the existing debt facilities of £65 million. Debt facilities can be drawn in the future to make new investments.

We continue to focus on ensuring that we create value and deliver stable returns for our shareholders through the expansion, improvement and diversification of our portfolio. With global commitments to achieving net zero from businesses and governments and COP26 taking place at the end of the year, this is a very exciting time to be investing in energy efficiency projects, which play an essential role in reducing carbon emissions.”

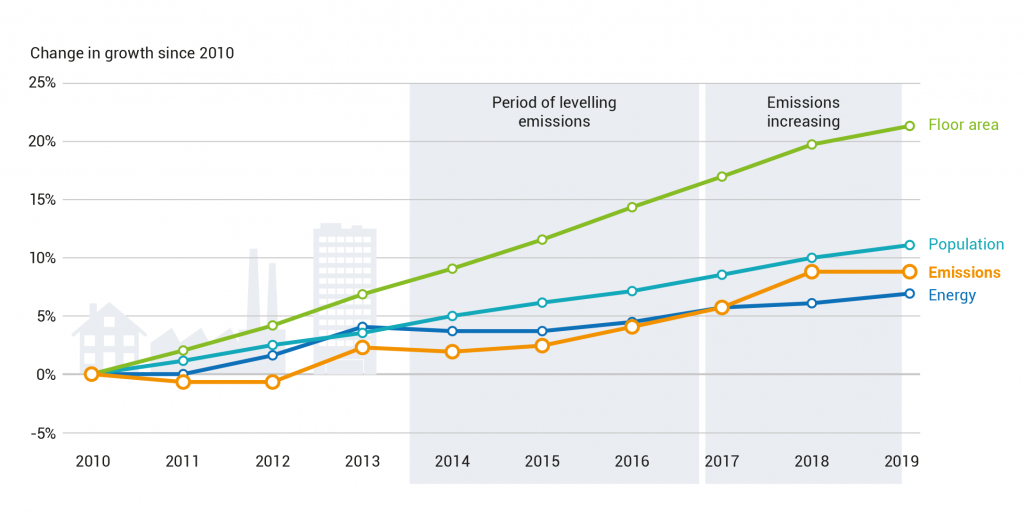

Emissions from the operation of buildings hit their highest-ever level in 2019, moving the sector further away from fulfilling its huge potential to slow climate change and contribute significantly to the goals of the Paris Agreement.

However, pandemic recovery packages provide an opportunity to push deep building renovation and performance standards for newly constructed buildings, and rapidly cut emissions. The forthcoming updating of climate pledges under the Paris Agreement – known as nationally determined contributions or NDCs – also offer an opportunity to sharpen existing measures and include new commitments on the buildings and construction sector.

Energy-efficient building investment rising

In 2019, spending on energy-efficient buildings increased for the first time in three years, with building energy efficiency across global markets increasing to USD 152 billion in 2019, 3 per cent more than the previous year. This is only a small proportion of the USD 5.8 trillion spent in total in the building and construction sector, but there are positive signs across the investment sector that building decarbonization and energy efficiency are taking hold in investment strategies.

For example, of the 1,005 real estate companies, developers, REITS, and funds representing more than USD 4.1 trillion in assets under management that reported to The Global ESG Benchmark for Real Assets in 2019, 90 per cent aligned their projects with green building rating standards for construction and operations. Green buildings represent one of the biggest global investment opportunities of the next decade, estimated by the IFC to be USD 24.7 trillion by 2030.

Further recommendations

Aside from calling for a green recover post-pandemic and updated NDCs, the report also recommends that owners and businesses should use science-based targets to guide actions and engage with stakeholders across the building design, construction, operation and users to develop partnerships and build capacity.

Investors should reevaluate all real estate investment through an energy-efficiency and carbon reduction lens. Other actors across the value chain should adopt circular economy concepts to reduce the demand for construction materials and lower embodied carbon and adopting nature-based solutions that enhance building resilience.

Climate and sustainable finance related executive orders signed on inauguration day

Last week on inauguration day, President Biden issued his first set of executive orders. These included re-joining the Paris Agreement and addressing the climate crisis, halting the Trump Administrations’ pending regulations, and expanding COVID-19 protections. These executive orders highlight some of the Biden Administration’s priorities : COVID-19, climate, racial equity, economy, healthcare, immigration and restoring America’s global standing.

DOL fiduciary duty rules go in effect, now under review from Biden Administration

Two Department of Labor rules went into effect last week: Financial Factors in Selecting Plan Investments and Fiduciary Duties Regarding Proxy Voting and Shareholder Rights. However, the Biden Administration will review a number of the previous administration’s actions, including Financial Factors in Selecting Plan Investments, under the Executive Order on Protecting Public Health and the Environment and Restoring Science to Tackle the Climate Crisis.